Less administration and maximum cover from your credit insurance

Less administration and maximum cover from your credit insurance

To get the most out of your credit insurance cover, your policy administration must be in order.

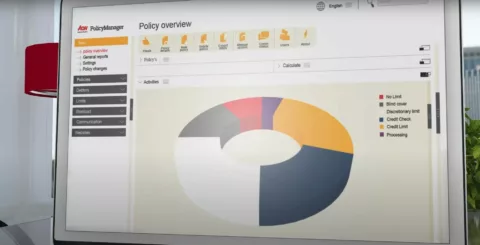

What if you could see at a glance the customers that expose you to risk, and how big that risk is? That’s what PolicyManager offers. And much more.

This user-friendly online application:

- takes care of administrative hassles;

- helps you to maximise credit limits;

- provides continuous visibility of the credit risks, both at group and local level;

- organises the turnover declaration to your credit insurer; and

- optimises the settlement of claims.

Especially when it comes to larger numbers of debtors.

PolicyManager makes it easier to meet policy conditions, deadlines and notification agreements more transparently. And you are always assured of sufficient credit limits.

A customer testifies

When HR services group Agilitas sought a credit insurance solution, it also immediately looked for a tool to manage the credit limits on its many thousands of customers. It found that tool in PolicyManager, which automates as much as 95% of Agilitas' credit limit reviews.

"Thanks to that automation, we can qualitatively manage the highest level of our credit limits - these customized ones - with a limited number of people," says Bart De Padt, Group Credit & Billing Manager of Agilitas Group.

Find out here how PolicyManager simplifies the management of your credit insurance policy

Get the most out of your credit insurance.

Enjoy this unique application for CRiON customers to minimize your policy administration and maximize your coverage.