Why credit management consultancy?Your benefits

Learn from the experiences and insights of others - not only our expert advisors, but also other credit managers like you - to optimise your credit management.

We support you in the development of your long-term credit management strategy while increasing your operational efficiency.

Why turn to CRiON?Our advantages

Practical recommendations

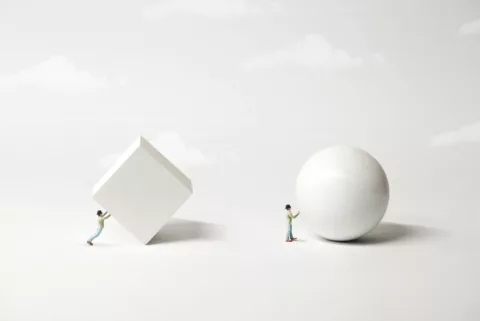

Whatever issue you bring us, we will always give you practical recommendations. “Resulting instead of consulting”, we call it.

Tailored approach

From a quick scan to optimise the most important aspects of your credit risk management to a thorough audit and fine-tuning of your entire credit management.

Inhouse expertise

Our advisers all have decades of experience in credit management. They will be happy to share their expertise with you.

Expert network

No one has a monopoly on wisdom, including us. That’s why we have built up a network of leading experts.

Result-oriented

Tired of consultants who make generic recommendations that don't work for your specific challenges? Rightly so!

CRiON delivers tangible solutions for your unique business circumstances. We formulate:

- practical action points

- well defined priorities

- development plans

- Screening

Tailored to your needs: from quick scan to full audit

- Benchmarking

Benchmarking against best practices in your sector and elsewhere

- Report

Unambiguous recommendations, clearly expressed.

- Action plan

Tangible action points, priorities and development plans - Implementation

Guidance in implementing the action plan, including in-company training

Our consultancy solutions

KOi+

Using this unique CRiON tool, we analyse your credit management quickly and easily during a guided assessment.

Benchmarking your result against your business sector shows you at a glance the most obvious points for improvement.

Quick scan

Screening the most important aspects of your credit management? Resulting in a concise advisory report with practical action points? Our quick scan is the answer.

Credit scoring

Speed up your credit scoring assessments and back them up with well-founded insights. In a structured and consistent way.

This is possible with our convenient dashboards, clear decision rules and hands-on workshops.

Optimising procedures

Are your organisation's credit management procedures comprehensive? And are those procedures applied in practice, or do they just exist on paper? How do you ensure that everyone involved in your organisation applies the same rules?

We provide concrete answers and recommendations to these and other questions.

Optimising organisation

How to create credit risk awareness throughout your organisation? How can you define roles and responsibilities in the credit management process better? How can you build a real shared service centre for credit management?

Inspired by best practices, we can carry out these and other projects on your behalf.

Talk to an experienced credit management consultant.

Your credit management is unique. So our first step is to listen to what you have to say.

Contact us now to optimise your credit management. With targeted screening and concrete action plans tailored to your needs.